Joint Ownership – which is the most appropriate option?

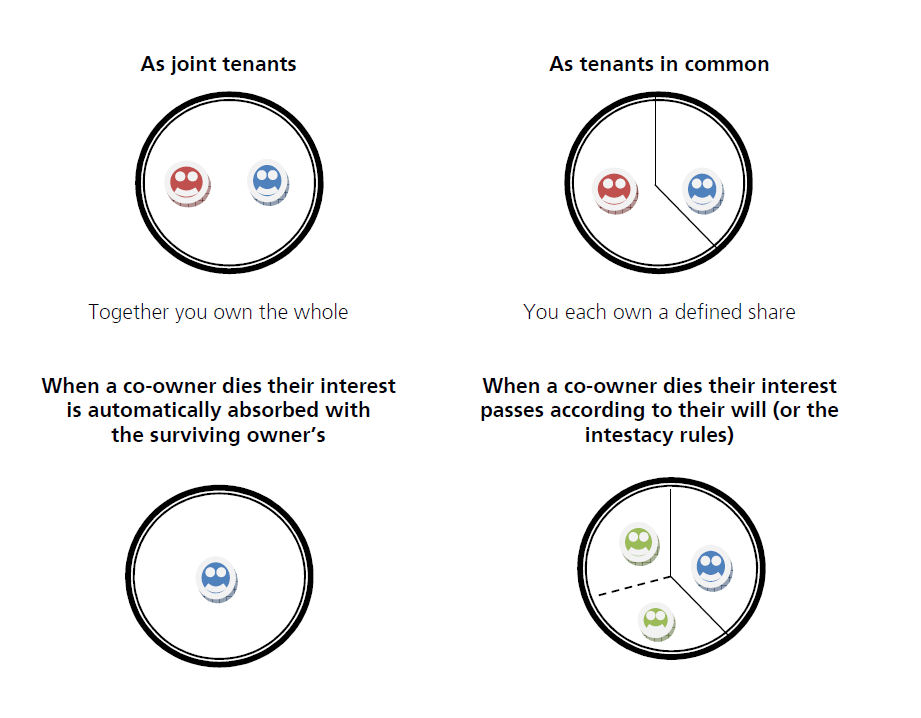

If you are purchasing a property together, it is necessary to decide whether you are going to hold the property as joint tenants or tenants in common. This is an important distinction because it governs how your respective interests in the property will be treated.

Joint tenants

If you hold the property as joint tenants, you will each have an undivided share in the property. This means that you will both own the whole, rather than an identifiable share of the property. The most important effect of this kind of share is that if one of you dies, your interest in the property does not form part of your estate (you cannot leave an interest held as a joint tenant to anyone in your will) and will pass automatically to the surviving party, who will then be free to deal with it as they choose.

This option is often preferred between co-owners who are married or in a civil partnership where they would want their r partner to have their share of the property, particularly since as between spouses or civil partners there will be no inheritance tax to pay on the deceased partner’s share. However, where the capital for the purchase price is being provided in unequal shares or you have children from a previous relationship whose expectations of inheritance need to be considered you should consider holding the property as tenants in common.

While this form of ownership is often preferred for co-owners who are married or in a civil partnership, it is not generally considered appropriate for co-owners who are not in such a relationship. You should accordingly consider and I would strongly recommend you hold the property as tenants in common.

Tenants in common

If you hold the property as tenants in common, your shares will be divided and treated as separate from the outset and each of you will be able to deal with your share of the property in your will subject to normal inheritance tax rules. This means that if one of you dies, your share will not pass automatically to the surviving co-owner. Instead, your share will pass according to your will or the rules of intestacy, if you do not have a will. The surviving co-owner will also not be able to deal with the property on their own but will have to act together with the personal representatives of the deceased owner. While it is always recommended that you make a will, it is therefore essential for all co-owners to make a will when property is held as tenants in common, both to ensure that representatives can be appointed as soon as possible and to pass the interest in the property to the appropriate person(s).

Declarations of Trust

Declarations of Trust

Unless stated otherwise, the shares held by tenants in common will be presumed to be equal. Therefore, if the reason for choosing to hold jointly owned property as tenants in common is due to e.g. unequal capital contributions, the appropriate shares should be recorded. To do this, the required shares can be included as simple statement in the transfer of the property or set out in a separate declaration of trust. If the shares are not recorded and equal shares are presumed, it may not be possible to persuade the court that different shares should be recognised and this can be the case even where significant sums of money have been spent on the property by one or other of the parties. Apart from the uncertainty of litigation, the potential cost of going to court to obtain a different share should also be born in mind. Fixing the shares can therefore avoid disputes, but if you decide at some point in the future to incur significant expenditure or some other action is contemplated that will change the original balance of the interests, you should enter into a new deed to acknowledge the resulting different shares. Having fixed the shares at the outset, you should also ensure that all subsequent outgoings and expenditure are apportioned on the same basis to maintain the relevance of the initial apportionment.

It is always possible that your individual circumstances might change, whereby one or more of you may wish to realise their interest in the property. This can cause great difficulty if you have not agreed how this will be dealt with in advance. It is therefore advisable that the declaration of trust should also contain provisions enabling each of you to serve a notice requiring the property to be sold, with the others being given the option to buy out the share of the party who wishes to sell at an appropriate price reflecting the market value of the property. If the departing party is bought out, it should also be provided that they will be released from continuing liability under any mortgage, so this will only work if the remaining party can afford to finance the property alone. I would also recommend that the declaration of trust contains provisions dealing with:

- payment of the mortgage to include provisions covering temporary inability to pay through illness or unemployment

- payment of rent and service charge under the terms of any lease of the property

- payment of insurance and other outgoings

- maintenance and upkeep of the property including a prohibition against making improvements unless mutually agreed

- the presence of visitors and guests at the property

- prohibitions against mortgaging or otherwise dealing with each party’s share in the property

- the death of one of the co-owners where the interest of the deceased does not pass to the survivor under the deceased owner’s will

- calculation of the share of the net proceeds of sale where one party moves out of the property permanently prior to sale

- calculation of the apportionment of liability for the payment of any negative equity where the proceeds of sale are insufficient to pay off the mortgage

If you would like a declaration of trust prepared please do advise us as soon as possible.

Declarations of Trust

Declarations of Trust